September 28, 2020 (SILVER SPRING, MD) – More land and operations have converted to USDA certified organic production over 2020, expanding the footprint of organics within U.S. agriculture according to the newly released Mercaris Commodity Outlook for 2020/21.

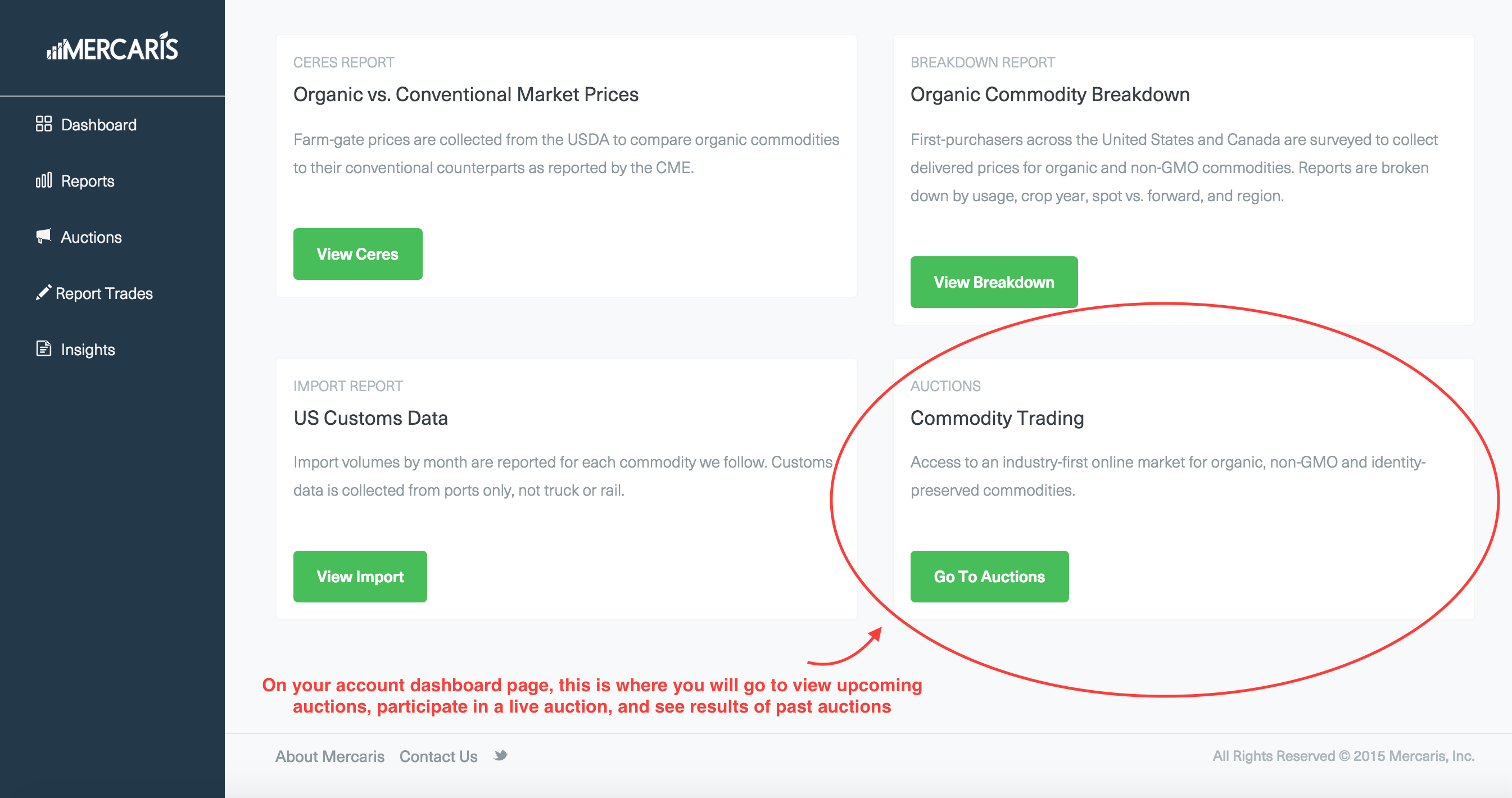

Mercaris, the nation’s leading market data service and online trading platform for organic, non-GMO and certified agricultural commodities, today released its annual outlook.

“The role of organic in U.S. agriculture continues to expand, bolstered by growing consumer preferences and challenging markets for conventionally grown commodities,” said Ryan Koory, Director of Economics for Mercaris. “And 2020 appears to be a clear reflection of this, as many crops are projected to see harvested acres reach record levels this year.”

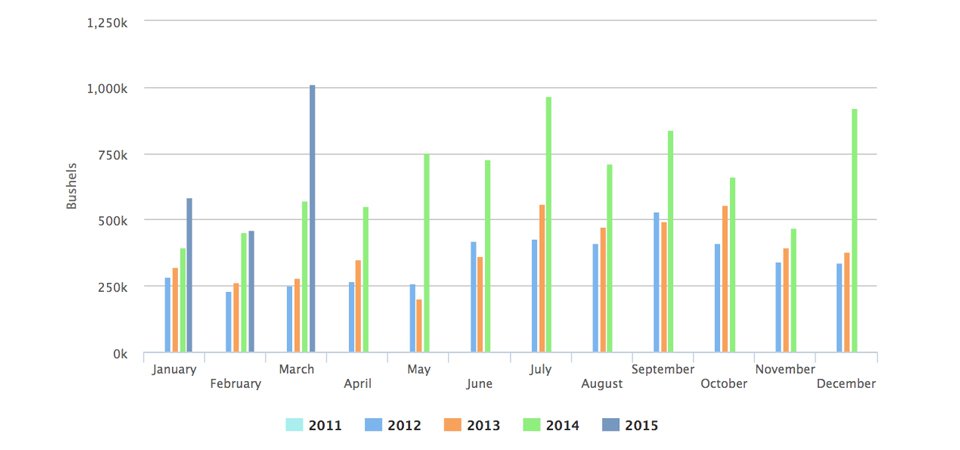

In total, Mercaris estimates U.S. harvested organic field crop area will exceed 3.4 million acres over the 2020/21 MY, up 4% y/y. In addition to more harvested acres, the 2020/21 yield outlook for many key U.S. organic crops is expected to rebound following 2019/20’s dismal planting and harvest weather conditions.

With larger U.S. organic commodity supplies on the horizon, growth in organic livestock production and feed demand will be critical over 2020/21. Following the rapid global spread of the novel coronavirus COVID-19, supply chains, trade partners, and U.S. households found themselves in an unpredictable new world. Despite this, U.S. organic consumer demand appears to have held up over 2019/20, with both organic broiler and turkey meat production achieving y/y growth.

“The expansion in organic turkey production this year has been nothing short of phenomenal. We estimate the daily rate of organic turkey slaughter jumped 147% over the past year. From 5,600 head per day over August 2019 to 13,800 head per day over August 2020. Maintaining Augusts’ slaughter rate alone is enough to significantly expand total organic turkey slaughter over 2020/21” said Koory.

Furthermore, Mercaris anticipates that U.S. consumer markets for organic protein will continue to expand in the 2020/21 MY, however, this outlook is largely dependent on the strength of the U.S. economy and consumer demand over the year to come.

Additional findings from Mercaris Commodity Outlook include:

• Mercaris estimates the number of certified organic operations in the U.S. will reach 19,888 over 2020/21, a 4% increase y/y. • Organic corn livestock feed use is projected to increase 6% y/y over the 2020/21 MY as organic poultry production continues to boost demand for U.S. organic grain feed. • U.S. organic soybean crush is projected to increase by 13% y/y over 2020/21as organic soybean meal imports plateau, and livestock feed demand continues to expand. • U.S. non-GMO soybean planted area expanded 19% y/y over 2020. • U.S. non-GMO corn planted area increased 8% y/y over 2020.

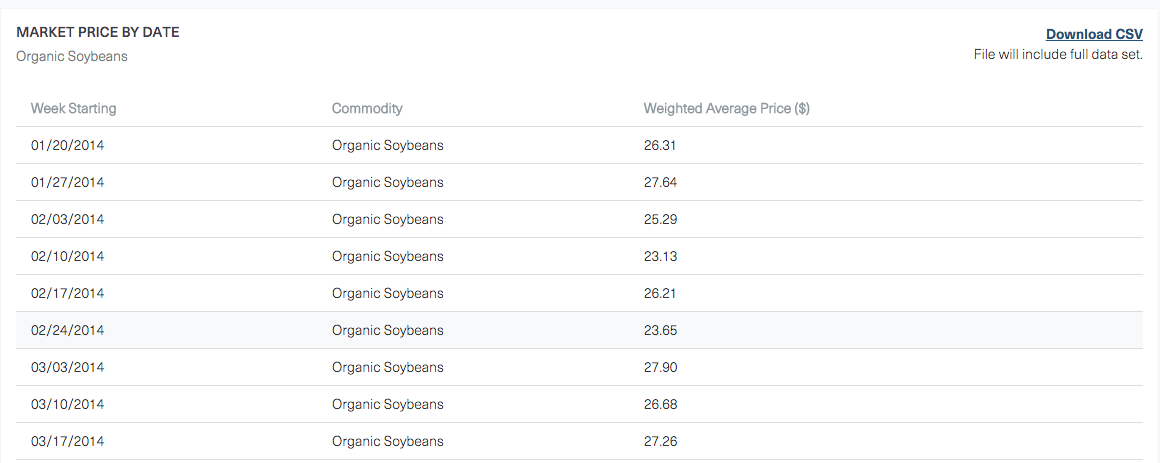

The outlook includes additional data and commentary on expected yields, use, prices, and more for organic commodities, as well as U.S. non-GMO acreage. For more information and to purchase a copy of the outlook, visit Mercaris.

For information about COVID-19-related risks to organic markets, a free Mercaris special report is also available here.

About Mercaris Mercaris, a Certified B Corporation, has helped its customers capitalize on the growing demand for organic and non-GMO agriculture by providing market intelligence, analysis, and trading services exclusively for the identity-preserved agriculture industry. Mercaris hosts the largest organic and non-GMO grain and oilseed market survey across the U.S. and Canada and recently launched an organic dairy initiative. The company also maintains a trading platform that enables buyers and sellers to find new markets and trade organic and non-GMO commodities. With a dynamic combination of data, insights, and technology, our customers can access solutions for every challenge. For more information visit: www.mercaris.com